The FGTS for financing, a modality that became available recently, emerged to help workers invest in the dream of owning their own home. Despite having some rules to be followed – like any other financing –, using FGTS money can be a good way out!

Before you go to request your financing, it is important that you check your FGTS balance (we will explain better how in the next topic) and see if your property and your name as owner meet the necessary requirements to make the request.

There are many requirements to apply for FGTS to finance a property and it can also be a little difficult to understand where this money comes from. Therefore, we have prepared this text and hope to answer all your questions. Follow the article!

What is the FGTS? Who is entitled?

So that you can use your FGTS for financing, you need to understand what this benefit is that, answering the second question, all workers are entitled to: the Service Time Guarantee Fund.

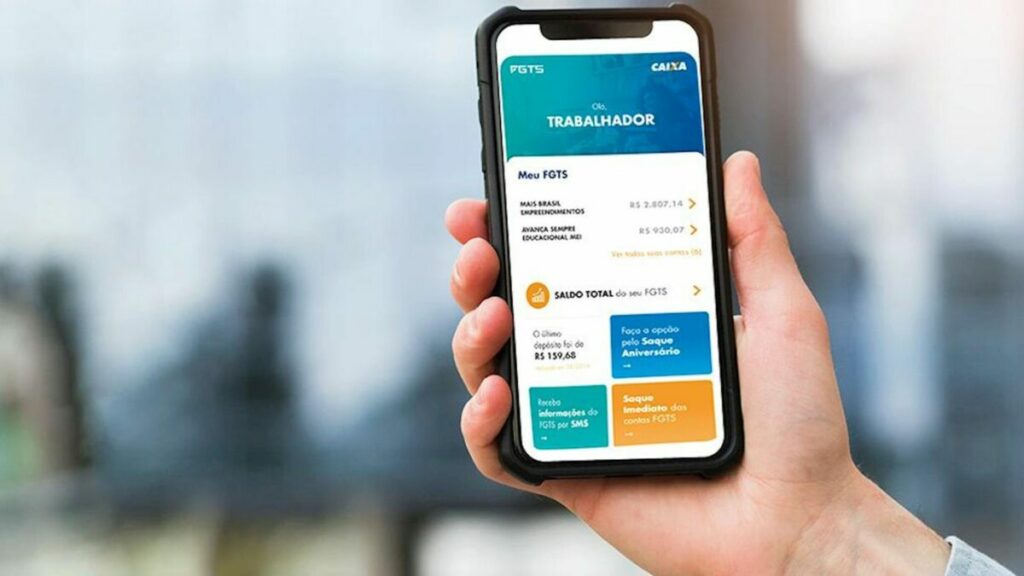

During your work in any company, your employer is obliged to deposit 8% of your salary every month into a Caixa Econômica Federal account. This account will serve as a savings account to protect workers who were dismissed without just cause and you can consult it in two ways: via the Caixa website, clicking here, or through the FGTS application, which we will leave the download links below.

This is the main situation, but there are also other more specific reasons why you can request your FGTS, such as a birthday withdrawal or an extraordinary withdrawal. And if you want to buy or build your property, you can also use the FGTS for financing. Follow the explanation below!

FGTS for property financing: how to apply? What are the conditions?

The first thing we need to explain about the FGTS for financing is that it can be used as a down payment on the value of the property, at the time of contracting, and constitute part of the payment or the total value of the asset.

This money, depending on how much you have in your account, can be used to reduce the amount of installments by up to 80% for 12 consecutive months or to directly buy the property. Everything will depend on whether or not you follow the conditions that are requested:

- At least 3 years of work under the FGTS regime, in any company or companies;

- The interested party must not have other active financing or be the owner of another urban residential property in the place where they live or work;

- The property cannot exceed R$1,500,000.00;

- It must be residential and the residence of the financing holder;

- Not be a rural or commercial property.

The FGTS for financing also cannot be used to expand or renovate the property, purchase construction materials or properties for the holder's dependents or other people. Despite there being many rules to follow, FGTS money can be a salvation for those who want to finance their own home! Understand better in Caixa website.

Read too: Discover the incredible app that pays you to walk; see how to download!

Now that you understand that you can use FGTS for financing…

FGTS for financing can help many people who need money to finally buy their dream home. Although it has its limits and cannot be used for other things, such as renovations, it is an amount that will certainly reduce expenses!

We hope this text has cleared your doubts about this benefit. And if you want to read more informative articles like this, including about the FGTS benefit itself, Click here and discover our blog, O Seriador!